texas auto sales tax

Services available at the Devine location. This page covers the most important aspects of Iowas sales tax with respects to vehicle purchases.

Car Tax By State Usa Manual Car Sales Tax Calculator

When you visit our locally-owned and -operated Ford dealer in Winnsboro TX one of our friendly and knowledgeable auto sales experts will help guide you through our inventory so that you can.

. A disability statement form is available from the Harris County Tax office. Clarification needed is the person who prepares and files the Certificate of Incorporation with the concerned state. The applicants physician must complete the form VTR-214.

The OCCC issues several licenses and registrations necessary for various consumer credit industries. Licensed industries include those that are required to obtain operational licenses from the agency and that are. Texas has the second-largest economy in the US with a gross state product of 176 trillion in 2020.

The purchasers 11-digit Texas sales tax permit number. Collection of Ad-Valorem taxes. If you do not receive a tax statement before November 1st of each year contact the Montgomery County Tax Office and request a statement be mailed.

Vehicles purchases are some of the largest sales commonly made in Iowa which means that they can lead to a hefty sales tax bill. Will I still have to pay penalties. The Office of Consumer Credit Commissioner maintains regulatory oversight of six categories of licensed industries and four categories of registered industries.

830 665-8010 Tax Phone. Again if you dont pay your property taxes in Florida the delinquent amount becomes a lien on your home. If the application is pending the resale certificate is valid for only 60 days.

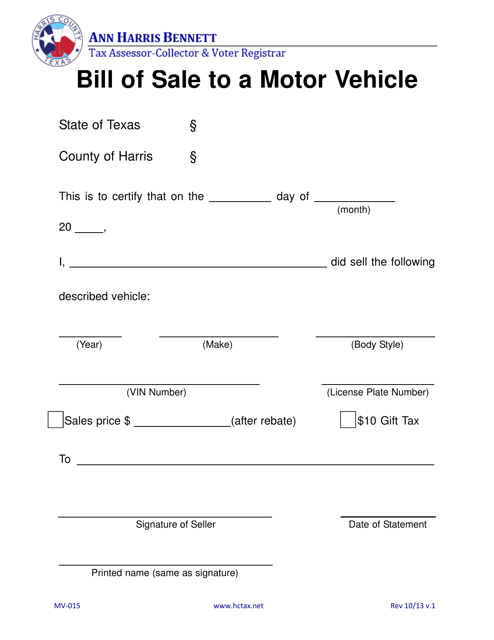

Tax-and-spend California permits direct sales but free-market-loving Texas doesnt Supposedly freedom-loving Texas has been one of the major fronts in the Tesla-vs-dealers conflict as. Harris County has approximately 2800 automobile dealers which includes 395 franchise dealers. The Texas Auto Title Company 13442 Bellaire Blvd Suite G Houston Texas 77083 Get Directions 832 619-1330 Mon-Fri 12PM - 6PM.

If a Property Tax Consultant also holds an active Texas real estate broker license or real estate sales license under Chapter 1101 or has an active real estate appraiser license or certificate licensed under Chapter 1103 TDLR will recognize and accept continuing education courses including courses on legal issues and law related to property tax consulting services. Registered agents are responsible for receiving all legal and tax documentation on behalf of the corporation. Florida Property Tax Lien Sales and Tax Deed Sales.

In its decision in South Dakota vWayfair Inc the Court effectively stated that individual states can require online sellers to collect state sales tax on their salesThis ruling overturns the Courts 1992 decision in Quill Corporation v. It is the second-most populous county in Texas and the ninth-most populous in the United States. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price.

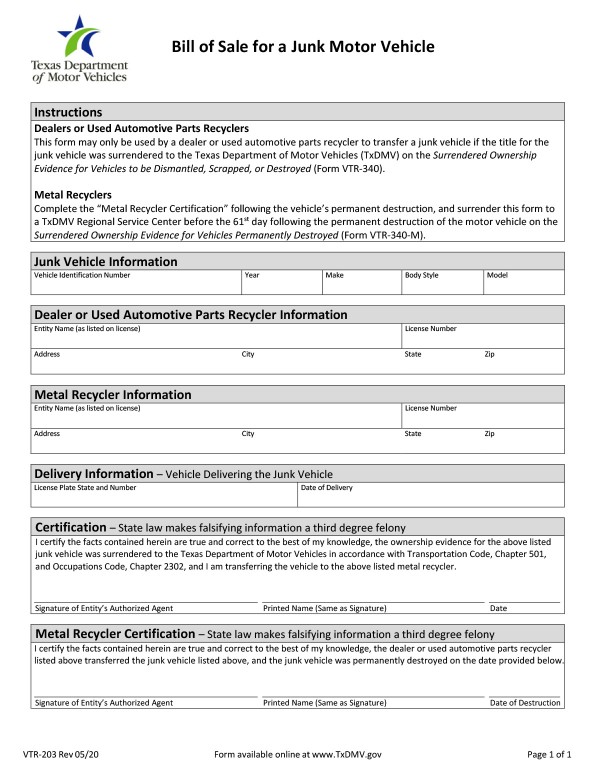

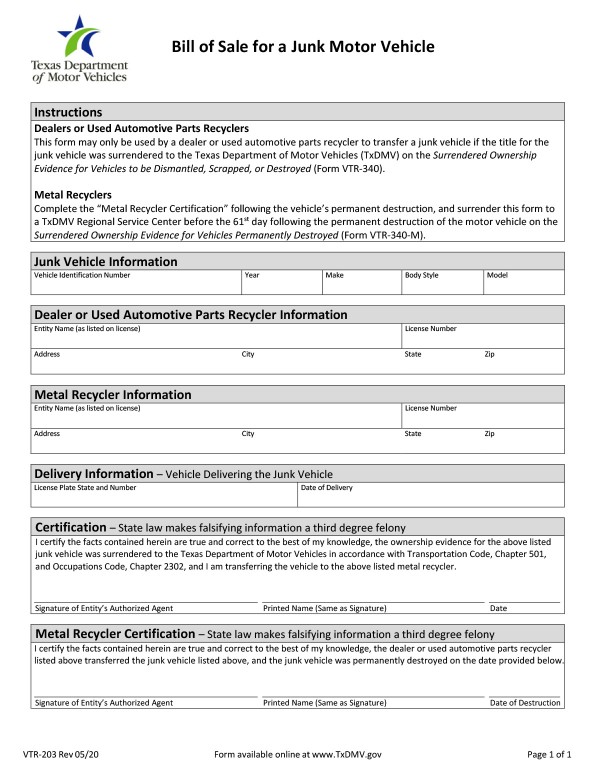

Texas does not impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016 effective July 1 2020. 817 500-0094 Contact Us Showroom. In Texas dealers dismantlers general businesses and exporters will need to provide Copart an operational license and a sales tax license for the same physical address as well as sales tax exemption forms.

Much of that money is made in the oil and gas industry though farming steel banking and. Hwy 132 N Devine TX 78016 Auto Phone. As of the 2010 census the population was 2368139.

For vehicles that are being rented or leased see see taxation of leases and rentals. Its county seat is Dallas which is also the third-largest city in Texas and the ninth-largest city in the United States. The Harris County Tax Assessor-Collectors Office performs approximately 32 million vehicle registrations and 940000 vehicle title transfers in Harris County each year.

What if I did not receive a tax statement and my account goes delinquent. Iowa Sales Tax on Car Purchases. Here at Texas Country Ford were proud to provide an incredible selection of new Ford vehicles for sale to East Texas drivers.

An out-of-state permit number or the registration number assigned to the purchaser by the purchasers home state. Welcome to Texas Country Ford in Winnsboro TX. After that date a new resale certificate should be issued which lists the permanent permit number.

The Texas Sales and Use Tax Permit is issued by the Texas Comptroller of Public Accounts. The physicians signature must be notarized unless a separate written original prescription is submitted. Share per value refers to the stated minimum value and generally doesnt correspond to the actual share value.

On June 21 2018 the United States Supreme Court fundamentally changed the rules for collection of sales tax by Internet-based retailers. Federal law included a grandfather clause for those state and local governments including Texas who imposed a tax on internet services prior to Oct. This clause expired on June 30 2020.

Once theres a tax lien on your home the tax collector may sell that lien. Dallas County is a county located in the US. If you purchased the car in a private sale you may be taxed on the purchase price or the standard presumptive value SPV of the car whichever is higher.

830 665-8031 Hours of Operation. 6618 Northeast Loop 820 North Richland Hills TX 76180-7844 Get Directions.

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Form Mv 015 Download Fillable Pdf Or Fill Online Bill Of Sale To A Motor Vehicle Harris County Texas Templateroller

Texas Bill Of Sale Form Templates For Car Boat Fill Out And Download

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Texas Car Sales Tax Everything You Need To Know

Registration Fees Penalties And Tax Rates Texas

Free Texas Dmv Bill Of Sale Form For Motor Vehicle Trailer Or Boat Pdf